2023 payroll tax withholding calculator

The payroll tax consists of two halves - one half is paid by the employee and one half is paid by. This is a more simplified payroll deductions calculator.

Estimated Income Tax Payments For 2022 And 2023 Pay Online

All payroll is processed and paid on a semi-monthly pay period schedule.

. We also offer a 2020 version of this calculator. We also offer. NE Suite 3500 Albuquerque NM 87106.

A payer may also send you a Form W-2G if it withholds part of your winnings for federal income tax purposes. If you win a non-state lottery prize of 10000 the payer could withhold 24 upfront to pay the IRS in the event you fail to report the winnings at tax time. Self-Employed defined as a return with a Schedule CC-EZ tax form.

This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA. 1000 am - 200 pm Monday - Friday Payroll Department. Pay dates are the last work day on or before the.

MSC01 1230 1 University of New Mexico Albuquerque NM 87131 Phone. John and June Perovich Business Center 1700 Lomas Blvd. Americas 1 tax preparation provider.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. 1 online tax filing solution for self-employed. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

You will find the amount of withholding in box 4 on the form. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Payroll taxes are always deducted directly from each paycheck so you rarely have to pay additional payroll tax on your income tax return.

As a result many taxpayers are unaware of the true amount they pay in payroll taxes. The Payroll Office is responsible for the final payroll process that issues payment advices via direct deposit and payroll checks if applicable to all regular full-time part-time and temporary employees of the Prince William County School Board. 800 am - 500 pm Monday - Friday Window Hours.

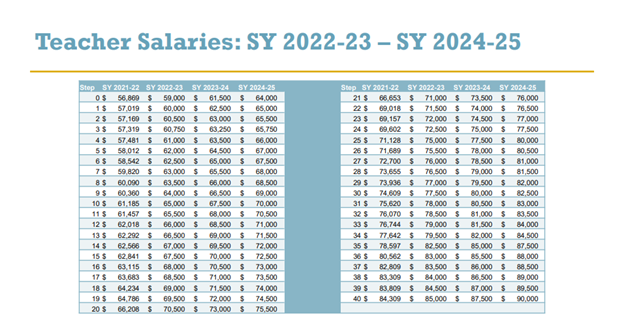

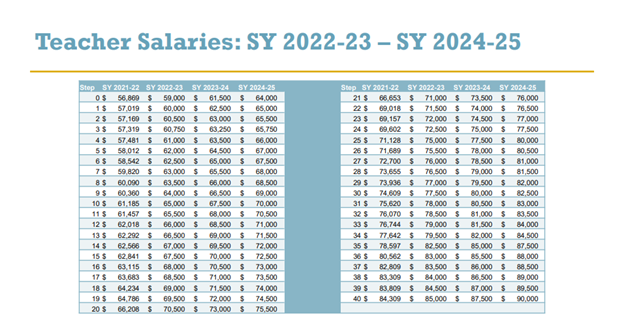

Hisd Announces Teacher Salaries Raises Through 2025 News Blog

Tax Estimators For 2022 Returns In 2023 Estimate Your Taxes

Social Security What Is The Wage Base For 2023 Gobankingrates

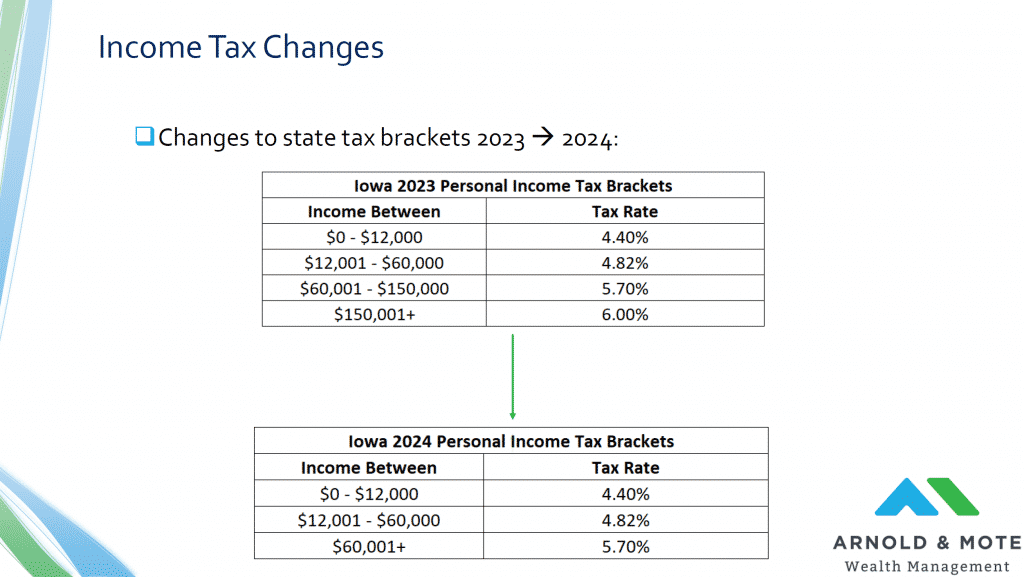

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

1120s Form 2022 2023

Form 941 For 2023

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

2023 W 4 Form Professional Calculator And Pdf Online

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Tax Withholding Estimator 2022 2023 Federal Income Tax Zrivo

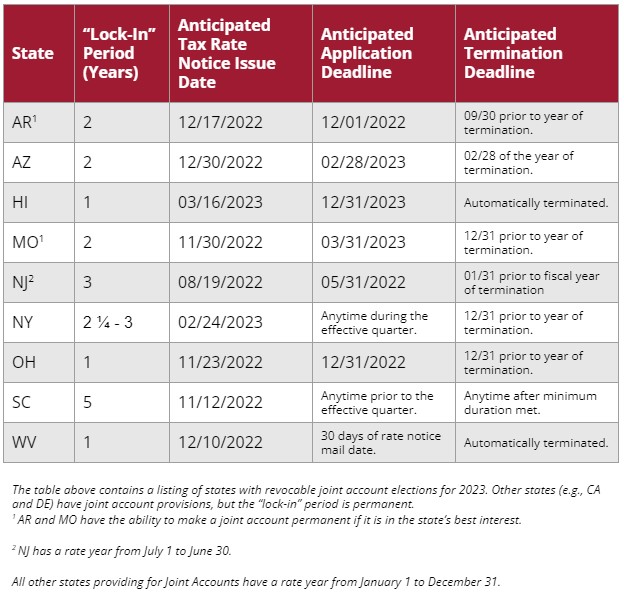

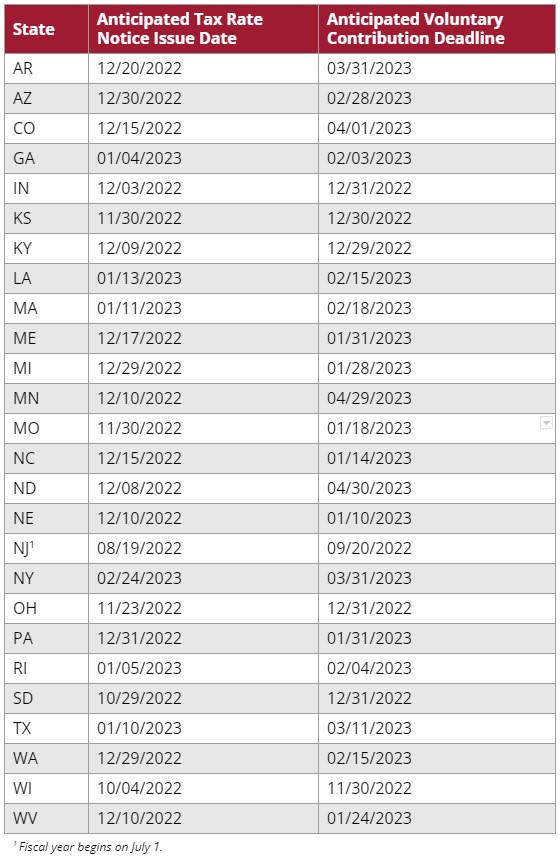

Strategies To Help Reduce Sui Tax Burdens In 2023 And Beyond

Strategies To Help Reduce Sui Tax Burdens In 2023 And Beyond

2022 2023 Tax Brackets Rates For Each Income Level

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits